China’s

change of fertiliser export tariff rates includes cancellations, increases as

well as decreases. The overall export trend is likely to go up in 2017 as a

result of the changes, according to CCM.

Source: Pixabay

The

new Notice on Tariff Adjustment Scheme in

2017, that was revealed on December 23, 2016, contains several different

changes for China’s fertiliser export. CCM has analysed the adjustments in a

comparison to 2016:

The

main fertilisers, whose export tariff rates are completely canceled in 2017 are

nitrogen fertiliser, including urea and ammonium chloride, as well as the ones

of nitrogen and phosphorus compound fertilisers.

The

export tariff rates of phosphorus fertiliser are going to be increased. Other

materials are triple superphosphate and other calcium superphosphate.

A

decrease in export tariff rates will be found for NPK compound fertilisers. The

value was 30% in 2016 and will be reduced to 20% in 2017.

Finally,

no change is going to happen to the export tariff rates of potassium

fertilisers. This is also including potassium chloride and potassium sulphate.

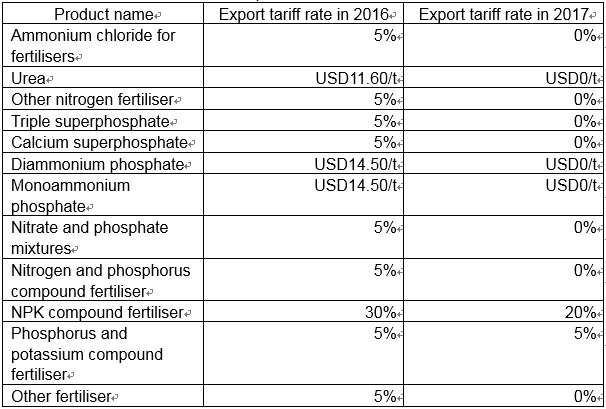

China’s fertiliser

export tariff rates in 2016 and 2017

Source: CCM & The

Customs Tariff Commission of the State Council

The

changes are a result of China’s effort to get rid of outmoded capacity that can

be found in the fertiliser industry. In general, the fertiliser industry in

China is facing a difficult time. Recently China has abolished most of the

favorable policies for this industry, they are facing partly sharp increasing

costs resulting out of environmental protection efforts and the overall sinking

demand of fertilisers due to decreasing international crop prices.

The

total export of fertilisers from China has been 25.03 million tonnes from

January to November 2016, according to China Customs, which represents a down

of 20.5% in comparison to the same period in 2015. The value of the export was

USD5.90 billion, a down of even 39.3% year on year.

The

cancellation and decrease of the export tariff rate of many fertiliser are therefore

getting necessary because the Chinese fertiliser industry needs to get rid of

the outmoded capacity of fertilisers. A reduced tariff rate will lead to a

bigger competitiveness of Chinese manufacturers in the international market and

will increase the export volume of fertilisers very likely.

CCM

has the opinion, that Chinese manufacturers should also reduce their production

of fertilisers to cause a lower supply that supports increasing prices in the

middle-term. A stable volume would not support any increasing profit of those

companies and even worse, lead to a higher pollution that as a return even

increases the costs once more, lead to a resource waste and backfire to lower

profits.

CCM

also adds, that the strong dollar is currently keeping international fertiliser

prices low, leading to more losses of Chinese manufacturers, if they are

keeping their production level on a high grade.

About CCM:

CCM

is the leading market intelligence provider for China’s agriculture, chemicals,

food & ingredients and life science markets.

Do

you want to find out more about the phosphor market in China?

Join our professional online platform today and

get insights in Reports, Newsletter, and Market Data at one place. For more

trade information on fertilisers visit our experts in trade analysis to get your

answers today.